All Categories

Featured

Table of Contents

For the majority of individuals, the largest trouble with the limitless banking idea is that preliminary hit to very early liquidity brought on by the prices. Although this disadvantage of unlimited banking can be decreased substantially with appropriate plan style, the very first years will certainly constantly be the worst years with any Whole Life policy.

That stated, there are certain limitless banking life insurance policy policies created primarily for high early cash value (HECV) of over 90% in the initial year. Nonetheless, the long-lasting efficiency will certainly typically significantly delay the best-performing Infinite Financial life insurance policy plans. Having access to that extra four figures in the first couple of years might come with the expense of 6-figures later on.

You in fact obtain some substantial long-lasting benefits that assist you redeem these early prices and afterwards some. We find that this prevented early liquidity trouble with boundless financial is a lot more mental than anything else when thoroughly discovered. In truth, if they absolutely needed every penny of the money missing out on from their boundless financial life insurance policy in the first couple of years.

Tag: limitless financial concept In this episode, I speak about financial resources with Mary Jo Irmen that shows the Infinite Financial Concept. With the increase of TikTok as an information-sharing platform, financial recommendations and approaches have actually found an unique way of dispersing. One such approach that has actually been making the rounds is the boundless financial principle, or IBC for short, gathering endorsements from celebs like rapper Waka Flocka Flame.

Within these plans, the cash worth expands based upon a price established by the insurance provider. Once a significant cash value collects, insurance holders can acquire a cash worth loan. These car loans vary from standard ones, with life insurance coverage offering as collateral, implying one might lose their insurance coverage if borrowing excessively without appropriate money value to sustain the insurance coverage costs.

And while the appeal of these policies is apparent, there are natural limitations and risks, requiring attentive money value monitoring. The strategy's legitimacy isn't black and white. For high-net-worth individuals or entrepreneur, specifically those utilizing methods like company-owned life insurance policy (COLI), the benefits of tax obligation breaks and compound growth could be appealing.

Infinite Banking With Whole Life Insurance

The allure of infinite financial does not negate its obstacles: Cost: The fundamental need, a permanent life insurance policy plan, is more expensive than its term equivalents. Qualification: Not everyone receives entire life insurance due to extensive underwriting procedures that can exclude those with details health and wellness or lifestyle problems. Intricacy and threat: The detailed nature of IBC, combined with its risks, might prevent several, specifically when simpler and much less risky choices are readily available.

Alloting around 10% of your month-to-month earnings to the plan is just not practical for many people. Making use of life insurance policy as an investment and liquidity source needs self-control and monitoring of plan cash value. Speak with a monetary advisor to determine if boundless banking straightens with your concerns. Part of what you read below is just a reiteration of what has actually currently been claimed above.

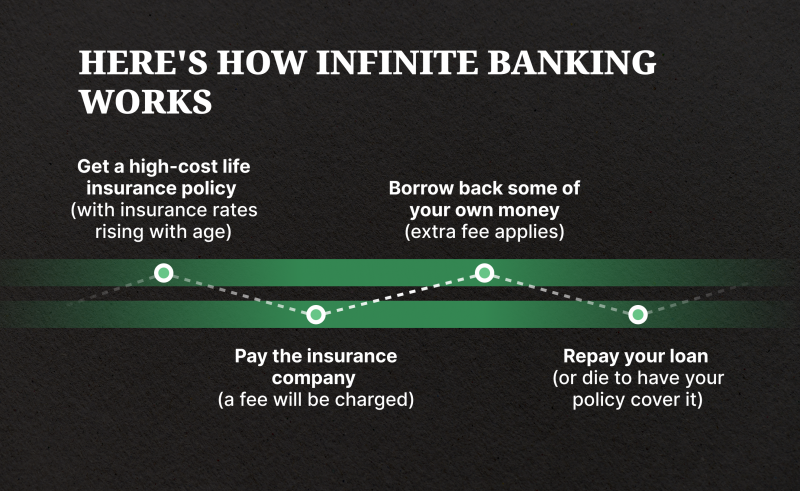

So prior to you get yourself right into a circumstance you're not planned for, understand the following initially: Although the principle is typically sold as such, you're not in fact taking a loan from on your own. If that were the instance, you wouldn't need to repay it. Rather, you're borrowing from the insurer and need to repay it with rate of interest.

Some social media posts advise using money value from entire life insurance coverage to pay down credit rating card financial debt. When you pay back the financing, a portion of that passion goes to the insurance policy business.

For the initial several years, you'll be repaying the commission. This makes it incredibly hard for your policy to build up worth during this time. Entire life insurance expenses 5 to 15 times more than term insurance policy. The majority of people just can not afford it. Unless you can manage to pay a few to numerous hundred dollars for the next years or more, IBC won't function for you.

Is Infinite Banking A Scam

Not everyone should depend entirely on themselves for economic security. If you call for life insurance policy, here are some important suggestions to consider: Think about term life insurance policy. These policies supply insurance coverage during years with considerable economic obligations, like home mortgages, pupil financings, or when taking care of little ones. Ensure to look around for the finest rate.

Copyright (c) 2023, Intercom, Inc. () with Scheduled Font Name "Montserrat". This Font style Software application is certified under the SIL Open Font Style Certificate, Variation 1.1. Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Scheduled Typeface Name "Montserrat". This Font style Software is accredited under the SIL Open Up Typeface Certificate, Version 1.1.Skip to main content

Rbc Royal Bank Visa Infinite Avion Card

As a certified public accountant specializing in realty investing, I've brushed shoulders with the "Infinite Banking Principle" (IBC) extra times than I can count. I've even talked to experts on the subject. The major draw, other than the evident life insurance policy advantages, was always the concept of developing cash money worth within a permanent life insurance plan and borrowing versus it.

Certain, that makes good sense. Honestly, I always assumed that money would certainly be better invested straight on investments rather than channeling it through a life insurance coverage plan Till I uncovered exactly how IBC might be combined with an Irrevocable Life Insurance Depend On (ILIT) to produce generational wide range. Let's begin with the basics.

Bioshock Infinite Bank Cipher

When you borrow against your policy's money worth, there's no set payment schedule, offering you the liberty to manage the car loan on your terms. The cash worth continues to expand based on the policy's guarantees and dividends. This configuration enables you to accessibility liquidity without interrupting the long-term growth of your plan, provided that the funding and interest are taken care of intelligently.

As grandchildren are birthed and grow up, the ILIT can acquire life insurance policy plans on their lives. Family members can take lendings from the ILIT, making use of the cash money worth of the plans to fund financial investments, begin companies, or cover major expenditures.

A crucial element of handling this Family members Financial institution is making use of the HEMS criterion, which means "Health and wellness, Education And Learning, Maintenance, or Assistance." This standard is usually included in depend on agreements to direct the trustee on just how they can disperse funds to recipients. By sticking to the HEMS requirement, the count on makes certain that distributions are created crucial demands and long-lasting support, guarding the trust's assets while still offering relative.

Enhanced Flexibility: Unlike stiff small business loan, you manage the repayment terms when obtaining from your own policy. This allows you to structure settlements in a manner that aligns with your service money circulation. infinite banking concept canada. Enhanced Capital: By funding overhead through policy financings, you can possibly release up money that would certainly or else be bound in typical car loan repayments or tools leases

He has the exact same equipment, yet has actually also built additional cash value in his policy and obtained tax benefits. And also, he now has $50,000 offered in his plan to use for future possibilities or expenses., it's vital to watch it as more than simply life insurance.

Infinite Bank

It's regarding producing a flexible funding system that provides you control and supplies multiple advantages. When used purposefully, it can match various other investments and service approaches. If you're intrigued by the possibility of the Infinite Banking Concept for your business, here are some actions to consider: Inform Yourself: Dive deeper into the principle through credible publications, seminars, or appointments with well-informed experts.

Table of Contents

Latest Posts

Infinite Banking Strategy

Be Your Own Bank Series

Build Your Own Bank

More

Latest Posts

Infinite Banking Strategy

Be Your Own Bank Series

Build Your Own Bank